So What Happens To Prices If The Tariffs Go Away?

Why would companies keep their prices high even if tariffs go away? Because it is in their best interest to do so.

In my previous piece on the likelihood of empty shelves, I explained why most businesses would have no choice but to pass on 100% of any tariffs they pay. The immediate next question should be fairly obvious: will prices go back down if tariffs abate? The answer is yes, with a very large asterisk that I will try to explain in the rest of this piece.

Before we get there though, let's revisit revenue, which is the money a business generates from selling their goods or services. For example: 100 units x $5 per unit = $500 Revenue. Without revenue every business will eventually fail, which is why companies are always trying to at least preserve, if not grow revenue. In practice, growth only comes from doing one, or both, of the following:

- Sell More Stuff (Volume)

- Increase Average Price (Rate)

No matter what you are in the business of selling, this is always the math problem. Returning to the clothing example from the prior piece, adding store locations would be a typical way to drive added volume. It expands your physical footprint and makes consumers aware of your brand in a way that online-only businesses can only achieve through marketing spend. The thing is, there are only so many stores you can add before the market gets saturated (and yes, I am ignoring adding new products for the sake of keeping this simple). So what do you do? Find ways to raise prices. It just so happens this trade war presents a unique "opportunity" to do so, if and when it ends.

Pricing In A Time Of Uncertainty

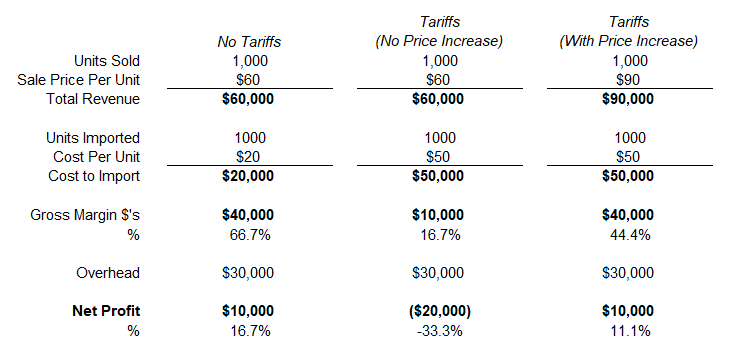

As we established, if you are still willing to import your goods at the higher upfront cost, you have to pass on the tariff impact to preserve your margins. The example for Chinese tariffs that I used previously is repeated below (tariffs rounded up to 150% for easier math).

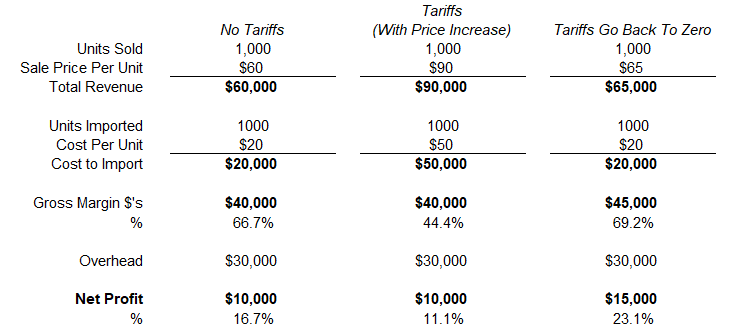

In this ongoing hypothetical, let's pretend that the Chinese tariffs stay in place for 6-12 months before uproar over widespread product shortages and a clear recession cause the tariffs to be dropped. Instead of prices reverting back to their original levels, I think what we'd actually see is something like the example below.

If everything else held constant (overhead, units sold, and non-tariff costs), our apparel company adding just $5 more translates into a 50% increase in net profit compared to the original No Tariffs scenario. This might be an extreme example, but companies are constantly trying to grow revenue/improve margins and we as consumers never have the full financial picture. If a company is raising their prices by more than their costs, we won't know that in the moment. The only way we ever find out is as part of an earnings release, and that only applies to publicly traded companies. At best, we do a gut check on whether the price feels "fair" relative to how badly we want or need the item in question. This is the real opportunity (derogatory) presented by the end of a trade war. A $65 shirt might suddenly sound very reasonable when you haven't been able to buy one for less than $90 for the last year. Whether you call this good business or price gouging mostly depends on which side of this transaction you find yourself on and how much information you have access to.

Said more simply, why would companies keep their prices high even if tariffs go away? Because it is in their best interest to do so. They would rather roll the dice on the increase and come down later than potentially leave margin on the table. As consumers, our only real lever is to not buy items we feel are unfairly priced. That's a little easier to do in categories like clothing where there are many price points to choose from, but much harder for necessities like food.

Other Stray Thoughts That Didn't Fit Well Into The Rest

Here are some other things I was thinking about while drafting this piece that I couldn't fit in the main body as neatly as I'd hoped.

- Price increase in general have been aided by consolidation across multiple industries. Fewer options for consumers means less competition pushing prices down. What options do we have for addressing this?

- What does all this mean for inflation? Companies love to just cite "inflation" as their justification for raising prices, but if they are increasing by more than their actual costs to juice margins, how should we think about that?

- Here is a report by Groundwork Collective arguing that surging corporate profits were a major driver of recent inflation.

- How will public companies materially impacted by tariffs present their financial results.

- Absent volume impacts, revenue growth from increased prices to offset tariffs isn't real growth in the traditional sense.

- Will the market punish companies that show revenue declines if/when tariffs come off?

- Recent historical examples that drove pricing volatility

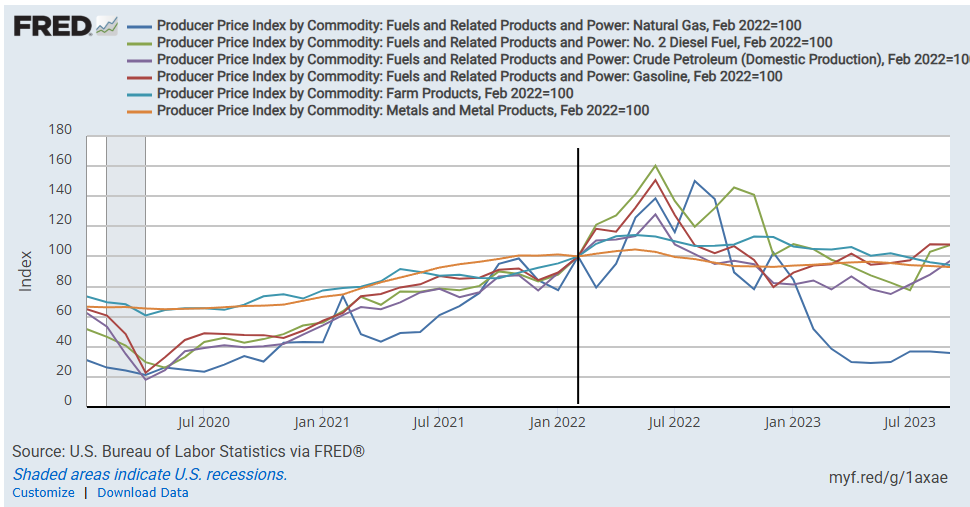

- The Russian invasion of Ukraine.

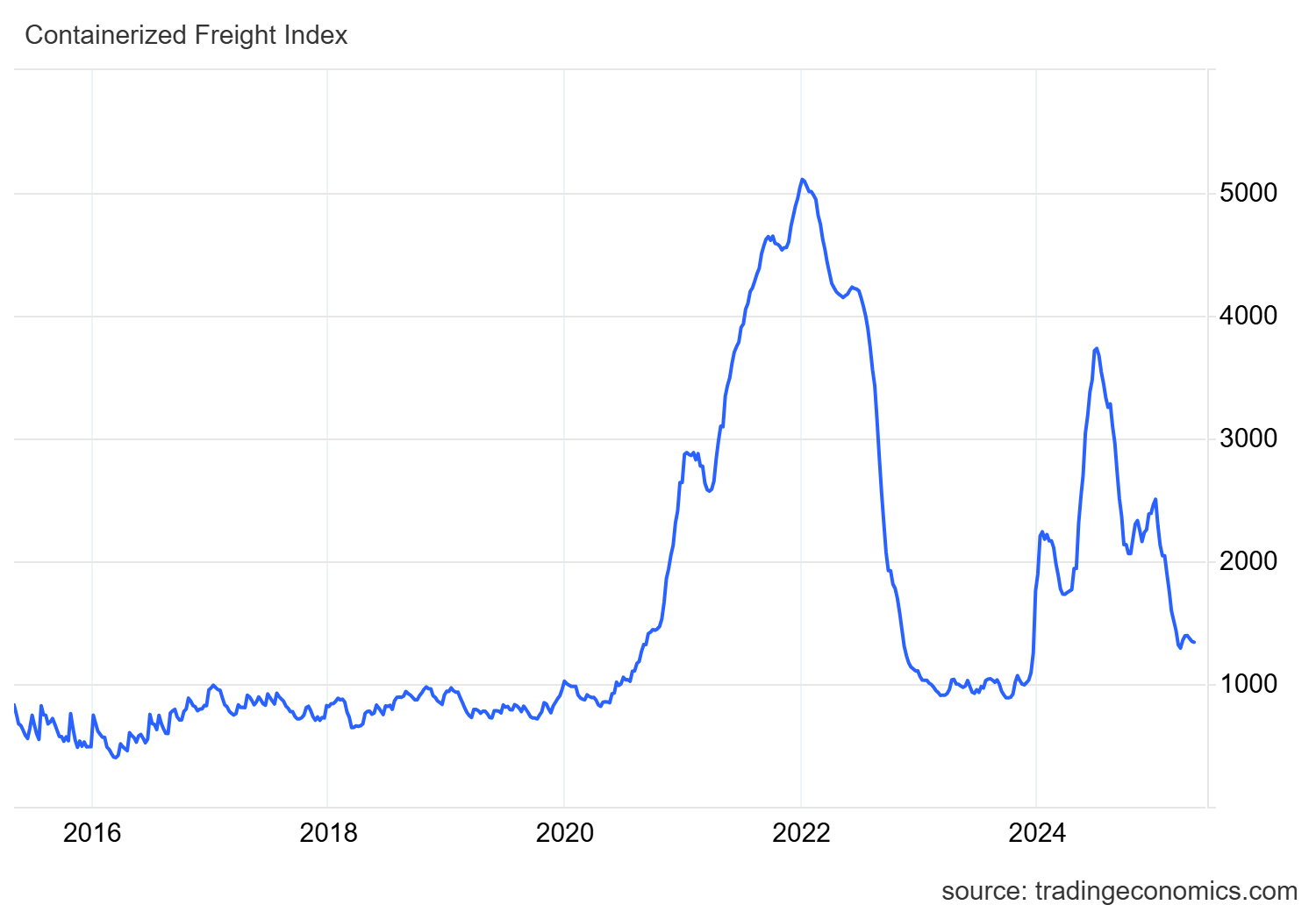

- Container shipping costs absolutely exploding twice in the last 5 years.

If you liked this piece and aren't already, please consider subscribing. Share with a friend or colleague.

If you find any typos or weird grammatical issues, no you didn't...