Let Them Eat Tariffs: News Roundup

Inbound shipping numbers look grim.

It's been a few weeks since my initial piece about tariffs, so I figured it was worth looking at what's been happening.

Author's Note: Of course the morning I sent this out they announce a 90-day "pause" that brings US tariffs on China from 145% down to 30% lol

Inbound Shipments Are Already Slowing Down

- Reporting from an NBC affiliate in Los Angeles on May 5th said that docked vessels are down by 44% at the Ports of Los Angeles and Long Beach versus last year.

“Every four containers means a job, so when we start dialing back, it means less job opportunity,” Gene Seroka, port of LA CEO, told Bloomberg News Sunday, predicting a sharp decline in dock work for employees, no more overtime or double time and potentially less than 40 hours of work a week.

“Less containers, less jobs, less business for truckers,”

Reporting from Sky says that 1 in 5 jobs in Long Beach are tied to the port. A slowdown in port activity of this magnitude will ripple across the economy. Laid off dock, trucking, and warehouse workers mean less money being spent in their communities, which puts pressure on everyone else.

- The Port of Seattle is experiencing similar slowdowns. Port Commissioner Ryan Calkins said they had no ships at berth on Wednesday May 7th. (link)

Commissioner of the port of Seattle: I'm looking out at the port of Seattle right now, and we currently have no container ships at berth. And that happens every once in a while in normal times. But it is pretty rare. And so to see it tonight is, I think, a stark reminder that the… pic.twitter.com/crSDjtkXfe

— Acyn (@Acyn) May 8, 2025

- Meanwhile, Trump says that ports slowing down and workers losing their jobs is a "good thing."

"We're seeing as a result that ports here in the US, the traffic has really slowed and now thousands of dockworkers and truck drivers are worried about their jobs," one reporter said in the Oval Office on Thursday.

"That means we lose less money ... when you say it slowed down, that's a good thing, not a bad thing," Trump replied.

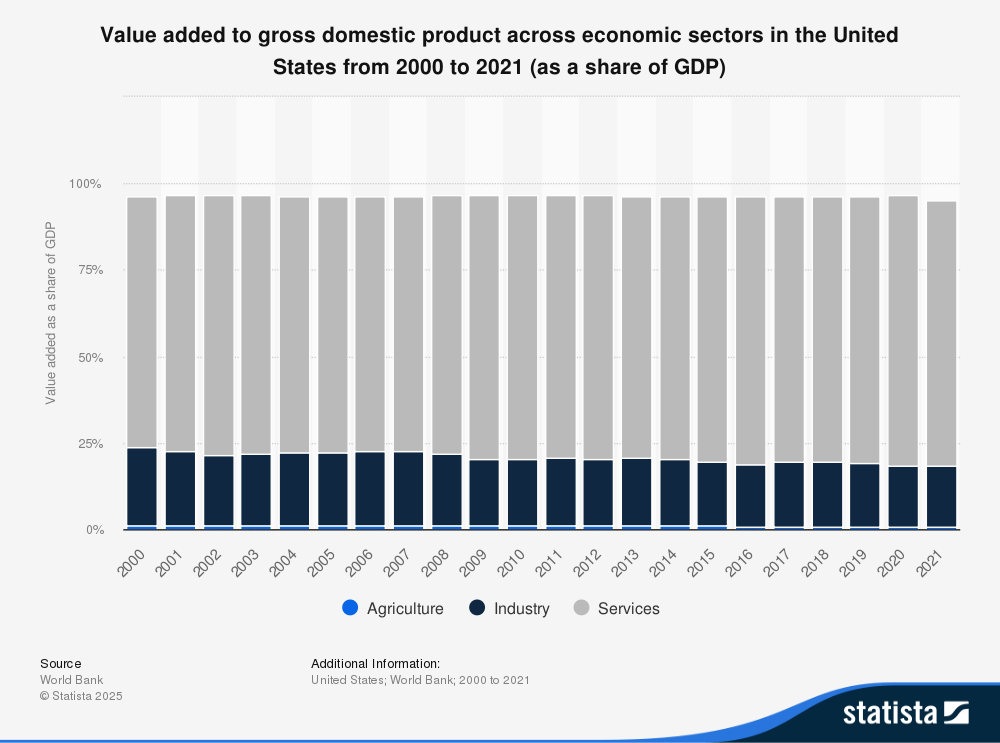

This all stems from Trump's misguided belief that trade deficits are a bad thing. As a quick refresher, if a country imports more than it exports from a trading partner that means they have a trade deficit. If it were the opposite that means there is a trade surplus. The important thing to remember is that this import/export balance is based on physical goods, while the vast majority of US GDP comes from services.

Changing our economy to be a net producer/exporter of goods would be a decades long undertaking and be a radical departure from the kind of jobs people in this country are accustomed to.

Increasing Prices

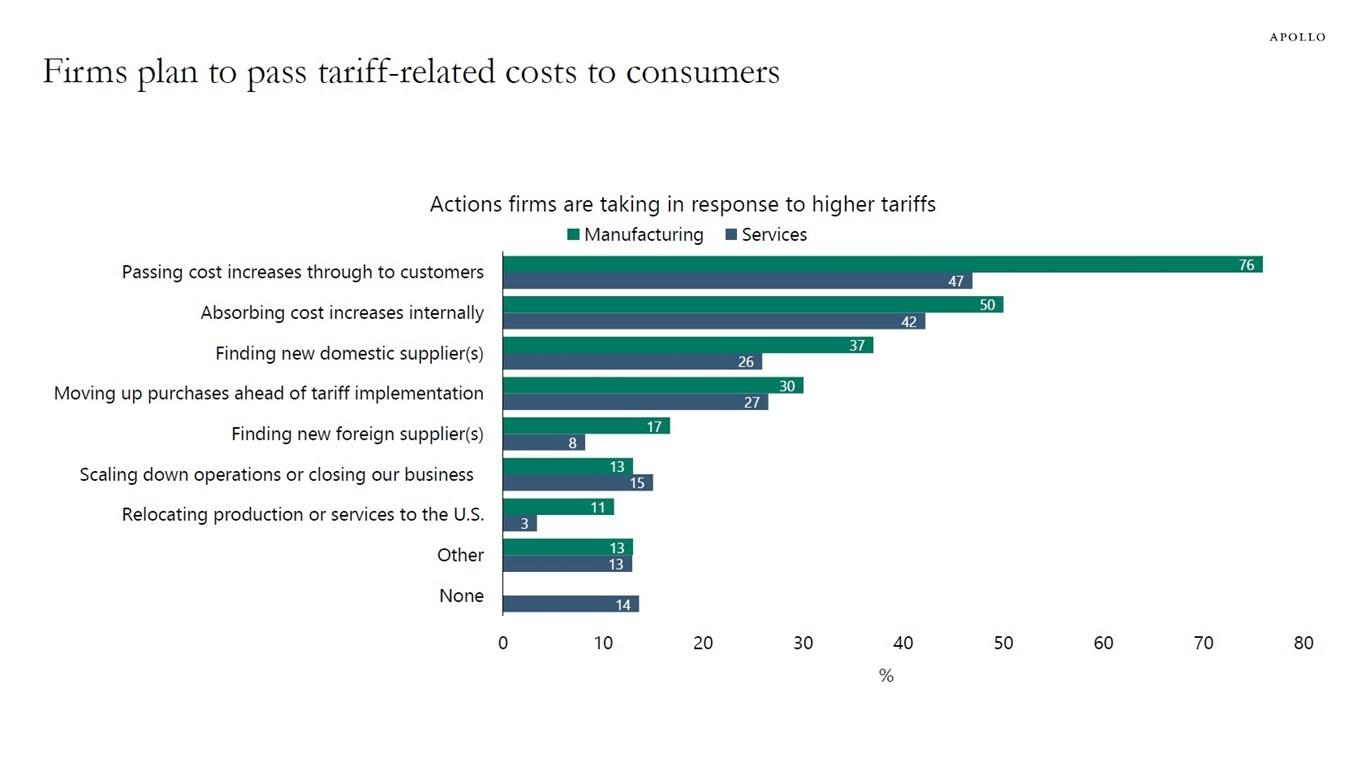

In the earlier tariff piece, I explained why most businesses would have to raise prices in response. Here is a Federal Reserve survey shared on May 5th by Apollo's Chief Economist Torsten Sløk.

- 76% of Manufacturing respondents said they would be passing on cost increases to consumers, while 50% said they would absorb cost increases internally.

- It would be great to know what % of respondents are relying on China versus countries with lower tariff rates.

- For those absorbing costs internally, how much? If the tariff impact is $20, and you pass on $18 and "eat" $2 then you are technically a yes on the first two questions. Companies would likely be making a calculation that by maybe absorbing some of the tariff that better pricing would let them make up the impact with higher sales volume. The main issue there is that it assumes general demand isn't suppressed from economic uncertainty and workers starting to lose their jobs across the different sectors.

- Only 11% of respondents mentioned relocating production to the U.S. Slightly more said they were considering scaling down or closing. More detail here could be really interesting.

- Is the number so low because domestic production would be too costly?

- Is it just too soon for most of the respondents to have seriously considered moving production yet?

The biggest issue for businesses aside from the tariffs themselves is the uncertainty this has all caused. Long term planning becomes extremely difficult when your import costs more than double overnight.

- Per the NYT, Mattel confirmed they plan to raise prices on their toys in response to tariffs (archive link).

Factories in China produce nearly 80 percent of all toys sold in the United States. Several U.S. toy companies have said they would likely raise prices because of the tariffs.

Mattel is one of numerous companies that suspended financial forecasts for this year, including General Motors, Snap and UPS, because of Mr. Trump’s economic policies. Mattel said that given the “volatile macroeconomic environment and evolving U.S. tariff situation, it was too difficult to predict consumer spending and U.S. sales for the year.”

It should be noted that it is usually a very bad sign when a publicly traded company says they won't issue forward looking earnings guidance. Specifically citing Trump's trade policies as the reason is unique to say the least.

- Bloomberg shared a great visual showing the impact of tariffs on a single container ship.

Howard Lutnick Says Let Them Eat Tariffs

On CNN this morning (May 11th) Commerce Secretary Howard Lutnick appeared to once again lie (at least in this author's opinion) about how tariffs work. While we did establish earlier in this piece that some businesses are willing to "eat" some of the tariff increases, that decision isn't without other impact. Countless American businesses that employ American workers depend on imports for their businesses to survive. Also worth mentioning the clip below, the 25% tariffs he mentions from Trump's first term were on select products only, so it isn't remotely the same to the blanket approach we are seeing now.

Lutnick: "We do expect a 10 percent baseline tariff to be in place for the foreseeable future ... what happens is the businesses and the countries primarily eat the tariff."

— Aaron Rupar (@atrupar.com) 2025-05-11T13:17:18.202Z

And here he is on Fox telling laid off workers they shouldn't worry while also seemingly admitting that 145% tariffs are "too high to do business." If they can eat the tariffs then why does the rate matter? It can't be both.

Lutnick on his message to dockworkers who are out of work: "You should be very optimistic and positive, because the president truthed it out, and I rely on the president."

— Aaron Rupar (@atrupar.com) 2025-05-11T13:44:02.966Z

Whenever you see Lutnick on television, remember that he is a billionaire that hasn't had to worry about his own financial security for decades and probably doesn't know what a week's worth of groceries cost.

A Trade Deal, Sorta

We announced a "trade deal" with the United Kingdom. If you'd like to see more of the specifics, Joey is a great follow on Bluesky and has a Substack piece explaining it in greater detail.

NEW from me: Trump’s trade “deal” with the UK is a farce—it only affects 0.3% of US imports, got basically no “concessions” from the UK, and barely lowered overall US tariff rates That’s an extremely bad sign for “deals” to come www.apricitas.io/p/farce-of-t...

— Joey Politano🏳️🌈 (@josephpolitano.bsky.social) 2025-05-10T14:50:48.077Z

This really felt like the White House wanted a positive headline on trade to offset the increasingly bad news we've already covered.

That's all for now. If you like these news round up/curation type posts, let me know! It can be hard to keep up with the news so hopefully this proved at least a little valuable.

Please consider subscribing or sharing with a friend!