Archive: The House Always Wins

Why Penn could give away Barstool, and just how much money there is in sports betting

This is an archive copy of a post that originally ran on Substack in August of 2023

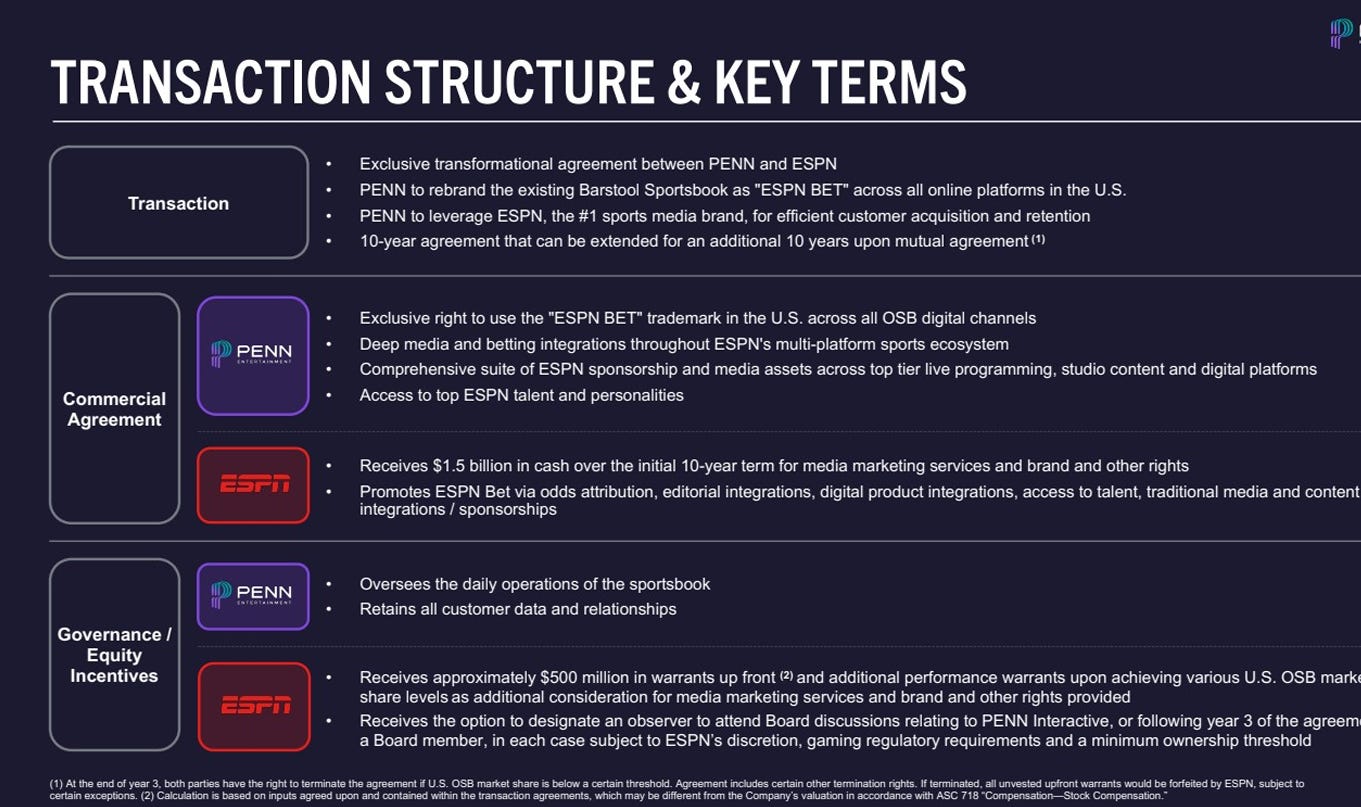

On August 8th, it was announced that ESPN would be launching a branded digital sportsbook in partnership with PENN Entertainment, called ESPN Bet. While this partnership was news on its own, the revelation that Barstool Sports, which PENN fully acquired mere months earlier for $388M (on top of $163M for an initial stake in 2020), would now be sold back to Dave Portnoy for $1 quickly became the bigger story.

While regulatory filings revealed that PENN would incur a pre-tax non-cash loss of $800-$850 million from “selling” Barstool back to Portnoy, it seems very clear that that cost was of little concern relative to landing a partnership with the Worldwide Leader in Sports. Was this breakup always in the cards? (Sorry couldn’t help myself) Even prior to buying the rest of Barstool, state gambling regulators had raised concerns over the partnership due to the often noxious history of the brand, as well as Portnoy himself. While one could call it deeply ironic that ESPN/Disney were apparently concerned with brand image in announcing a gambling partnership, it should ultimately be unsurprising that PENN were happy to cut Barstool loose in order to get the deal done. It is true that every acquisition has the chance to fail, but very few are unwound as quickly as this one. The market however clearly agreed with PENN that the long term benefits of this deal were worth it and the stock closed up 9% on August 9th. Let’s look into why.

How Big Is The Sports Betting Market?

For decades, Las Vegas was the only place to legally bet on sports in the United States, but that changed in 2018. In May of that year, the Supreme Court’s ruling in Murphy v. National College Athletics Association overturned a 1992 federal law (the Professional and Amateur Sports Protection Act) that had kept betting illegal in most of the country. By the end of 2018, seven states had passed laws legalizing sports betting. As of this writing, 37 states have fully legalized and launched sports betting, with rollout pending in a further three.

In 2023, it is clear that business is BOOMING. If you watch sports, whether in-person or on television, the celebrity-filled ads for online betting platforms are impossible to miss. Major sports teams have announced plans for sportsbooks inside of arenas and stadiums, and unlike the boom/bust of many crypto sponsorships, the casinos (and their betting apps) will be here to stay.

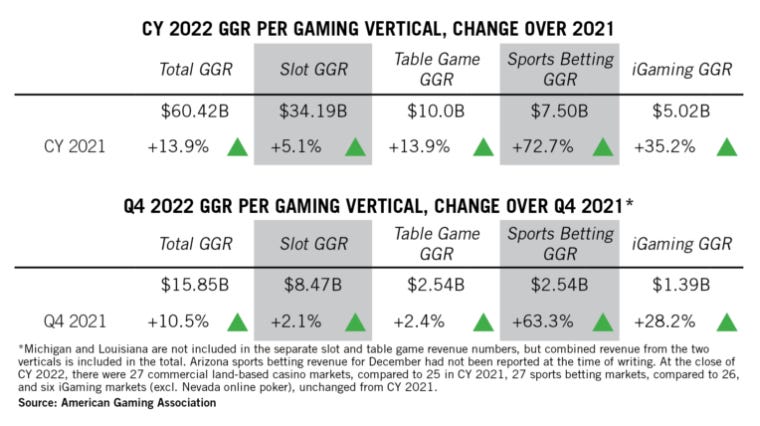

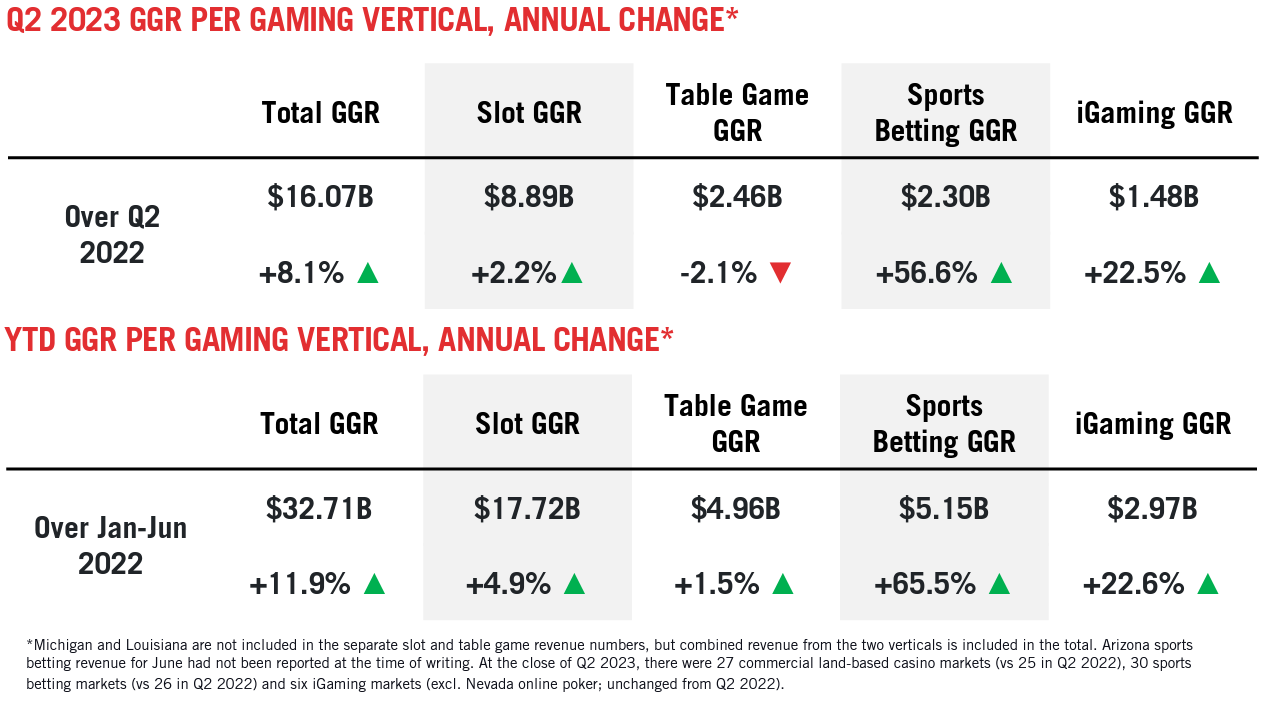

In the charts above and below, gross gaming revenue (GGR) is net of bets taken and winnings paid out. In 2022, legal sportsbooks handled over $93B in bets and generated $7.5B in revenue according to the American Gaming Association. While still only ~12% of total gaming revenue, sports betting has massively outpaced table and slot play in terms of annual growth. 2023 also shows no signs of slowing down. Sports betting revenue could eclipse $12B this year if the current growth rate holds. PENN clearly wants to make a play for as much of that market share as possible.

How Important Is This Deal To PENN?

*Quick disclaimer that none of this should be considered investment / financial advice and that I am not a PENN shareholder or plan to be in the future. I just find the mechanics of this deal and the growth of the sector fascinating*

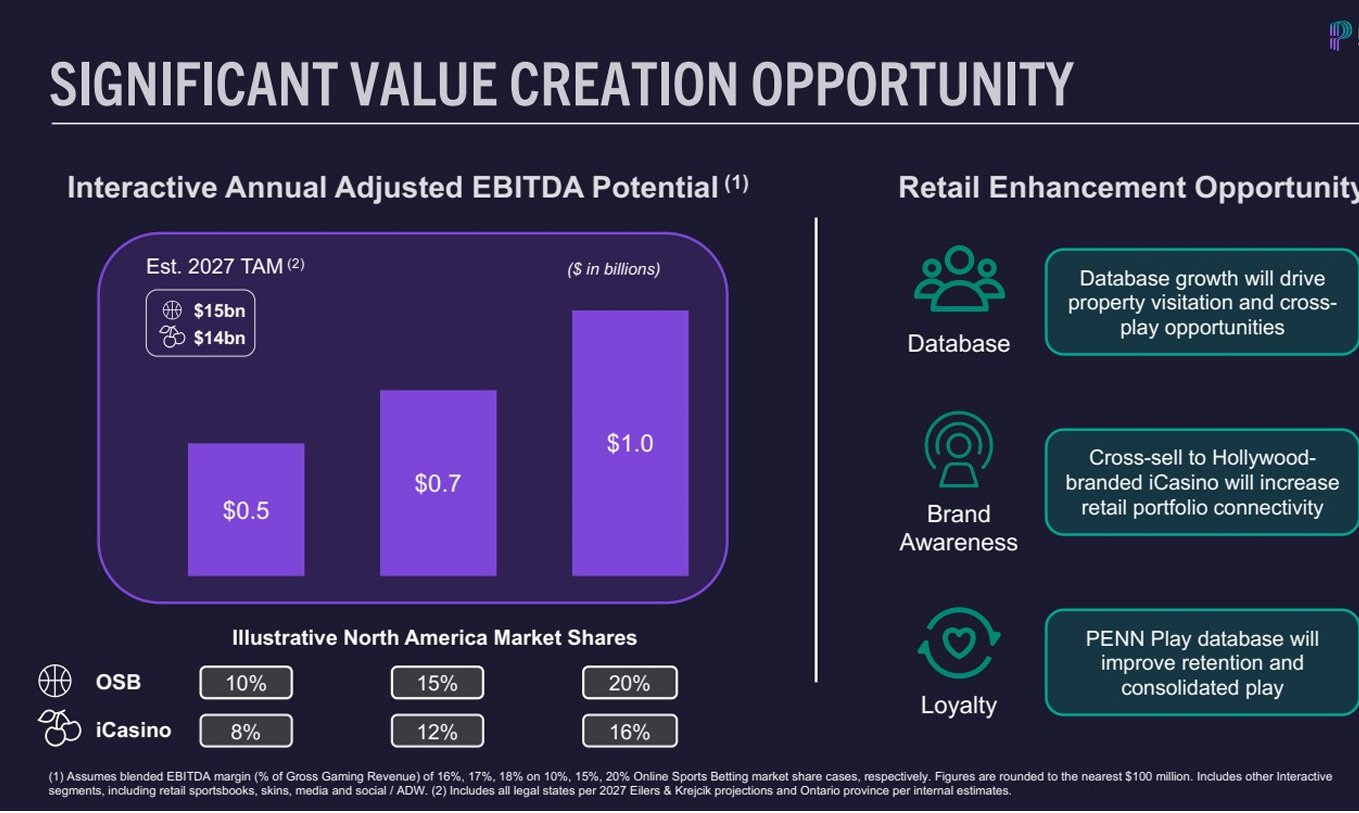

Per their 2022 annual report, PENN’s gaming revenue was $5.2B. Assuming PENN follows a similar GGR breakdown as the overall industry (the specifics do not appear anywhere in their public filings that I was able to find), that would mean sports betting could be contributing ~$600M in revenue. The investor deck outlining the partnership states that the launch of ESPN Bet could drive anywhere from $500M to $1B in EBITDA benefit by 2027.

ESPN is receiving both cash ($150M annually for 10 years) and stock warrants (valued at $500M upfront) as part of the deal. If PENN’s current sports betting revenue is indeed close to ~$600M, then they are gambling that giving up the equivalent of ~25% of today’s sports betting revenue is worth it in the long run. Based on the EBITDA margins mentioned in the first image above, PENN believes that by 2027 that this partnership could add between $3B and $5.5B in just sports betting revenue. Given that the slots and table game verticals are more mature and slower growing, it is possible that almost half of PENN’s total GGR could come from sports betting by 2027.

Just like the daily fantasy platforms (DraftKings and FanDuel) that preceded this explosion in traditional sports betting, this deal is first and foremost a digital play. As sports betting has become normalized and legal across most of the country, ESPN began tailoring some of its programming to match. Throughout the day you will see live odds scrolling the bottom of the screen as well as ESPN personalities discussing what they think are the best bets in an upcoming slate of games. But just because sports betting might be legal in a state, it does not necessarily mean that potential bettors live within ready distance of a physical sportsbook. Apps fill this void and introduce as frictionless an experience as possible to get those potential customers betting. There is an entire other conversation to have on the morality of making it this easy for people to lose their money with nothing to show for it, but it should already be obvious for purely business reasons why hundreds of millions are being spent to expand this market.

The Competitive Landscape

Whether talking about Las Vegas in the specific or the casino space more broadly, PENN’s primary competitors are MGM Resorts and Caesars Entertainment. To get a sense of scale, their 2022 results were as follow:

- PENN

- Total Gaming Revenue: $5.2B ($6.4B total)

- Market Cap as of 8/30/23: ~$3.6B

- MGM

- Total Gaming Revenue: $5.7B ($13.1B total per Annual Report)

- Market Cap as of 8/30/23: ~$15.4B

- Caesars

- Total Gaming Revenue: $6.0B ($10.8B total per Annual Report)

- Market Cap as of 8/30/23: ~$11.6B

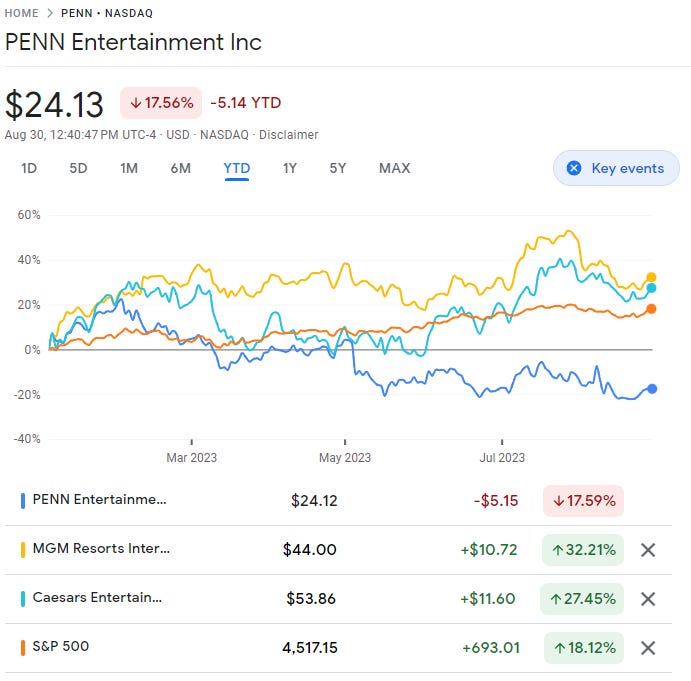

Here is year-to-date stock performance:

Despite all having total gaming revenues within $1B of one another, and whether by using top line revenue or market cap, PENN is clearly in third place. While the immediate announcement of the ESPN deal was worth 9% on the day, PENN’s stock is still performing substantially worse than its peers and the market at large. MGM & Caesars are, as of this writing, handily outperforming the S&P 500. There are many factors that drive stock performance, some of which are company specific, and others, like the overall weird economic vibes that were present for much of the year (read kyla scanlon for more on this), less so.

Based on my time working at publicly traded companies, narrative and perception matters just as much as delivering promised results. Actually changing that narrative/perception is extremely difficult. Splashy announcements like this one can be pitched as the start of a new chapter for a company, or just as likely viewed as desperate play for continued relevance. Which one this proves to be remains to be seen, but the amount of money at stake is very clear.