Archive: Data Sources You Should Know

Where to get economic data

Just because you say something doesn’t make it true, which means that any well constructed argument or analysis must include at least some evidence. The prior piece on the cost of housing for example, used Federal Reserve Economic Data (FRED) to show just how much home prices have increased in the last several years. When it comes to writing about finance, business, or the economy more broadly, there are thankfully very useful resources out there that also happen to be FREE. Here are some of the best:

Company Specific Data

When it comes to doing research on specific companies, any that are publicly traded are required to make regulatory filings with the SEC. All of those filings are freely available via the Electronic Data Gathering, Analysis, and Retrieval system more commonly known as EDGAR. Simply input the stock ticker of the company you wish to research and you will get a list of all their filings.

Here is a quick refresher on the primary SEC filings and what they mean:

- Form 10-K: This is the company’s annual report.

- Includes income statement, balance sheet, and statement of cash flows.

- All measures presented in this filing will be for the full fiscal year just completed and compare against prior fiscal years.

- The section entitled Management’s Discussion and Analysis of Financial Condition and Results of Operation is meant to provide additional context for the results as presented as well as supplemental information. The level of granularity can vary between companies but will often include more detailed disclosure on specific business segments and anything else that management feels will provide confidence in the current trajectory of the business without potentially being misleading.

- Form 10-Q: Quarterly report

- Same financial statements as the 10-K

- All measures will be presented for the most recently closed fiscal quarter and typically include comparisons to both the prior-quarter as well as the prior-year quarter.

- The Management Discussion section will cover many of the same topics as the 10-K but potentially in less detail.

- For 8-K: Disclosure of unscheduled material events

- The 8-K is typically where the most interesting things are disclosed and can cover any number of topics.

- Departure of high level executives

- Mergers & acquisition activity

- Substantial layoffs

- And MORE!

- These can be filed at any time the company wishes to inform shareholders of a material event with the company.

- The 8-K is typically where the most interesting things are disclosed and can cover any number of topics.

The purpose of these disclosures is to maintain a level playing field for all interested parties looking to make investing decisions. These filings along with their timing also serve to create the boundaries for potential insider trading charges. In addition to EDGAR, the Investor Relations page of any public company’s website will often include links to these filings as well as other documents like investor presentations and links past and upcoming earnings calls.

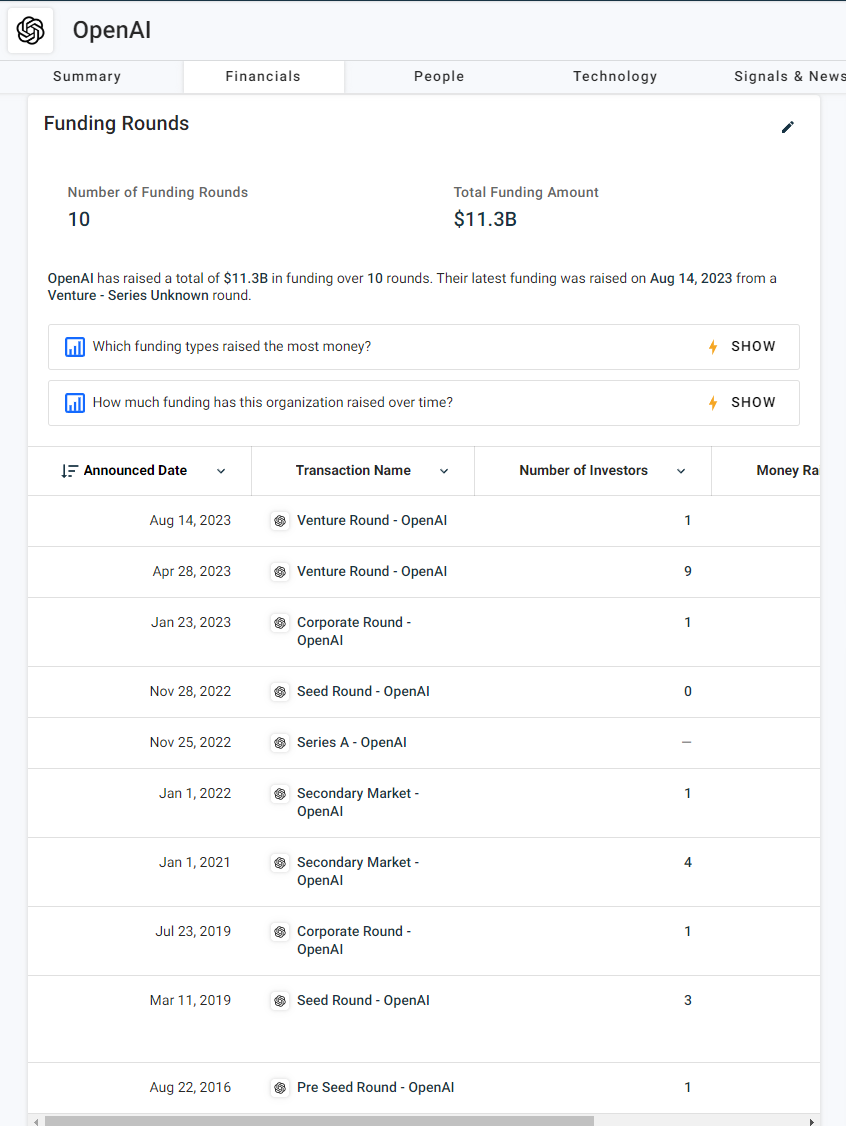

For privately held companies, options are few and far between. Crunchbase offers some free data for privately held companies but anything of more detail requires paying for their premium offering. For anyone researching startups, Crunchbase does freely publish high level detail on funding rounds and the associated investment firms involved. By their nature, privately-held companies only share what they are legally required to disclose. Anything beyond that should be viewed through a marketing lens.

Given how valuable much of this information could be, the majority of provider companies have instituted paywalls for access. That said, for those with access to enterprise funds, data services like Bloomberg, Morningstar, CB Insights, or Pitchbook become options.

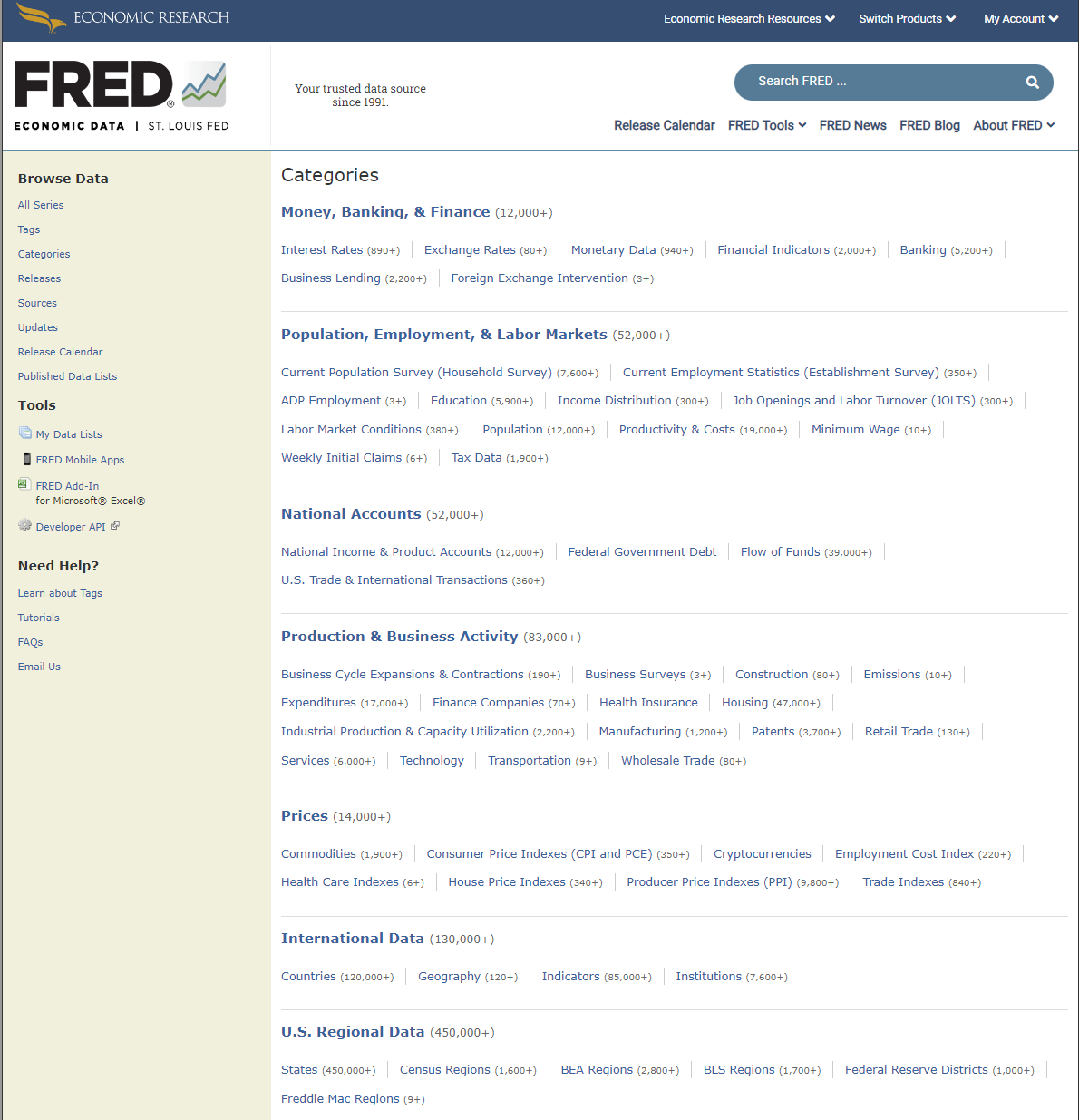

Economic Data

If you are trying to wrap your head around the current state of the economy as a whole, the data published by the Federal Reserve and its district banks is invaluable. The FRED catalog maintained by the St. Louis Fed contains thousands of pieces of economic data. If you are trying to understand a given economic trend then this is probably your best place to start.

Most importantly, all of this data is free to access and can be downloaded traditionally, via API, or Excel add-in. The only downside of the various data points included under the FRED umbrella is timing. Depending the specific item, getting the most up to date information will probably require waiting. The Fed itself can only make decisions based on the data it has and structures its meeting cadence accordingly.

Each of the individual Federal Reserve banks will also publish their own research and findings, including some recurring publications done by each bank. As an example, the Federal Reserve Bank of New York publishes their Quarterly Report on Household Debt and Credit which provides trending information on the various consumer debt categories for the past twenty years. Consider adding some of these bank publications to your recurring reading list.

The More You Know

Whether as business owners, consumers, voters, or investors, we are constantly searching for better sources of information with which to make decisions. Despite the phrase “do your own research” increasingly becoming a refrain of reactionary conspiracy theorists, it is a crucial skill to master in many aspects of life. Having an understanding of financial and economic data makes you a more informed citizen and less likely to be manipulated by grifters of all kinds.